Top Pricing Strategy Considerations Post-COVID

Where to start with adjusting your pricing strategy for the post-COVID new normal.

We celebrated Easter very differently this year. Due to the current situation and lockdown, all of the egg hunting events were canceled. We decorated the house with decorative pieces from last year. There were very few Easter chocolates and no candy filled Easter eggs for my 6-year-old son. We did not buy the table covers, disposable plates, Easter Bunny decorations, and other things that we would normally buy.

From a retailer’s perspective, the Easter assortment didn’t move much. Many of the specialty/ non-essential stores had to be closed for many weeks. The retailers are going through significant challenges including furloughing many of their staff members, dealing with supply chain issues, and in some cases, keeping themselves solvent. As the economy opens up again, there are fewer things retailers will have control over, and using data and analytics can help them navigate through the new reality.

4 areas to reassess your pricing strategy post-COVID

1. Understanding & Reacting to New Consumer Trends

Coming out of the COVID period, consumers will have a different outlook and perspective on how they shop and interact with retailers. No one knows how the world will be post-COVID, however, we can anticipate that shopping trends and customer behavior will change. It will be important for retailers to understand how consumer preferences, purchasing habits, price perception, and promotion responsiveness will evolve.

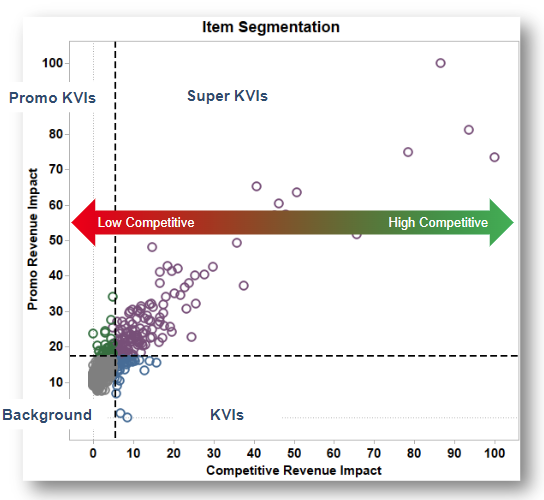

Retailers will need to re-evaluate which items they should be competitively shopping and which items are best to promote. Many of the products that were not considered sensitive previously will rise up in perception and previous price-sensitive items will move towards being background items. It will be essential for retailers to quickly determine the most critical, highly responsive items in a category as “Super KVIs”. Items with high promotional response will need to be handled delicately and used to build promotion strategies with the vendor. Defining the right set of KVI/EDLP items based on new shopping behavior will allow retailers to allocate the right investment into these items. Depending on the retailer, this strategy formulation has to be done at the Enterprise level or by banner, channel, division, or season.

In addition, Basket Analytics—what people put in the basket along with other items—can provide a wealth of information during this period. How have consumer consumption and purchasing habits changed? For example, convenience store retailers are seeing a trend towards larger pack size products in snacking, increased basket size in units and revenue, but the longer duration between trips.

Utilizing Basket Analytics effectively can shed light on how basket behavior has evolved during and post-Covid. Here are some questions to consider. Has the basket behavior changed? Is the share of promoted items in a basket higher than pre-Covid? Which items are people buying together, that were not purchased together previously? Are customers buying larger/smaller packs or quantities? Can retailers drive the purchase of multiple or larger packs through up-purchase incentives? Should they work with suppliers to shift their assortment to larger pack sizes?

2. Managing Excess Stock

COVID has created a lot of left-over stock that was not sold during its intended season. As stores begin to open, retailers are faced with the challenge of quickly selling this inventory to make room for new merchandise. As they reopen stores, retailers are observing pent up demand from customers coupled with a significantly lower level of sales compared pre-COVID. Retailers will need to decide whether they get aggressive selling out the excess/out of season stock or, instead, get aggressive in driving margin due to this pent-up demand.

Using data and analytics to determine the key product trends, price elasticity, seasonal sales, post-peak selling patterns, and an ability to learn and react quickly will be essential for retailers to navigate through these times. Customers will want to get back to normalcy as soon as possible and will look forward to seeing expected assortments in the stores. For example, retailers will need to clear inventory and shelf space by certain outdates for Christmas merchandise. Once a product has been identified to have little or no demand, retailers will have to make tough decisions swiftly and figure out ways to clear the inventory, without spending too much time and energy.

3. Effective Channel Strategy

During COVID, online sales increased significantly. But post-COVID, will it return to normal? Will there be a larger online share for fewer categories going forward? What is the sales contribution of BOPIS sales? Retailers also need to determine ways to engage with new customers that shopped during COVID. Retailers will need to tap into other data sources that may not have been relevant to them previously in order to understand market share across the new channels and evaluate variation in customer price sensitivity between the channels. This will enable retailers to define the right pricing strategy as an online share increase.

4. Strengthen relationship with Vendors

Retailers and vendors have both struggled through the COVID period. Retailers will rely on vendor support for ongoing promotions once stores start opening. However, vendors will likely need to reduce spend and lessen their level of support. Retailers will have to find creative ways to deal with reduced vendor support.

Merchants will have to make the case with their suppliers to support promotions that are effective and will provide a win-win for both retailers and vendors. Additionally, merchants will need to find creative ways to run promotions that meet performance objectives. Learning and reacting quickly to new customer trends will help address customer and vendor needs and identify which promotions are ok with less support, which ones need more support, and which promotions should be stopped.

Assess and Adjust

In order form a pricing strategy post-COVID that attract and delight consumers during this period of time, retailers must become adept at comparing pre and post behaviors, trying out new strategies, continuously measuring and learning from the results, and adjusting their strategies.

Want more advice on how to adjust your pricing strategy post-COVID? Check out our other articles on how to rethink your markdown and promotions strategies!

Aditya Rastogi specializes in Retail Pricing Strategy and Advanced Analytics. He partners with retailers to define pricing strategies and integrating science-backed insights into the business processes. Aditya brings extensive experience in retail merchandising, promotional planning and process governance.