Retailer Survey Reveals 2022 Holiday Pricing Insights

How inflation is impacting holiday promotions and pricing confidence as retailers close out 2022

The holiday season always has the retail industry feeling a certain way. But with yet another year of unprecedented challenges and changing customer behaviors, 2022 seems different.

Is it anticipation? Uncertainty?

According to the results of our 2022 Pricing Survey, the answer lies somewhere in the middle — and with a particular air around pricing confidence. That’s why we dove deep into our findings to uncover the key pricing trends impacting retailers as the year comes to a close and what they mean for the holiday season.

Here are four key trends we found.

1. Confidence is high, but not for everyone

Optimism seems generally high across retail organizations, but there are noticeable differences across regions, types of retailers, and departments.

The North American slump

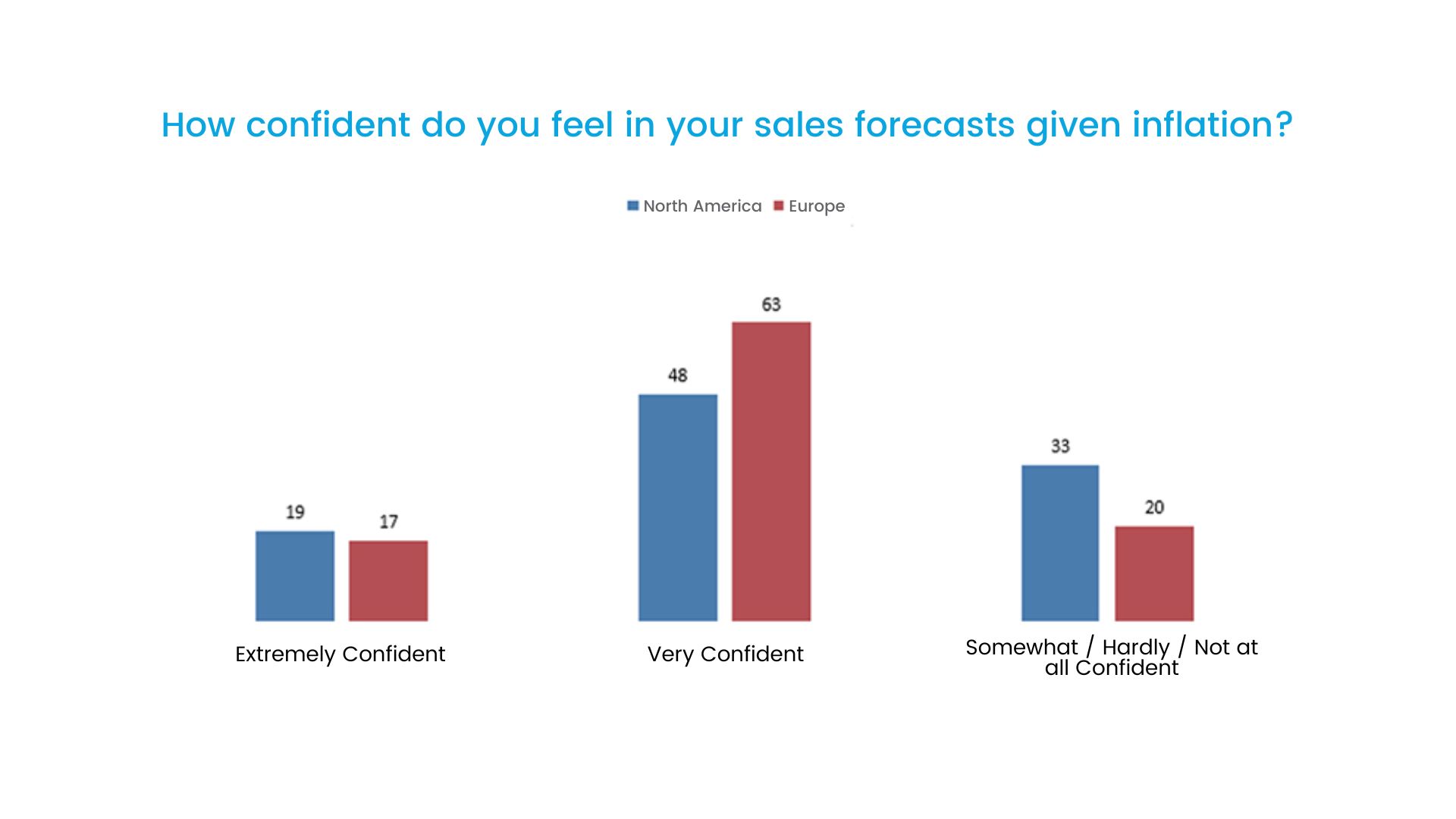

Despite inflation cooling from 9.1% in June down to 7.7% in October in the United States, North American retailers find themselves less confident about their sales forecasts and pricing strategies going forward than their European counterparts.

When asked to qualify confidence in their sales forecasts given the current inflationary environment, North American retailers trailed behind Europe by 13%. As for confidence in pricing strategy through the end of the year? Only 63% of North American retailers feel confident compared to 76% of European retailers.

Larger companies are less confident

Our survey also uncovered a correlation: the larger the company, the less confident it is in its pricing strategy. While 77% of retailers with between 450 and 999 employees are highly confident in their pricing strategy through the end of the year, that figure slides down to 59% for retailers with 1,000 to 9,999 employees and even lower to 40% when the company has a headcount of 10,000 or more.

Pricing strategies impact confidence

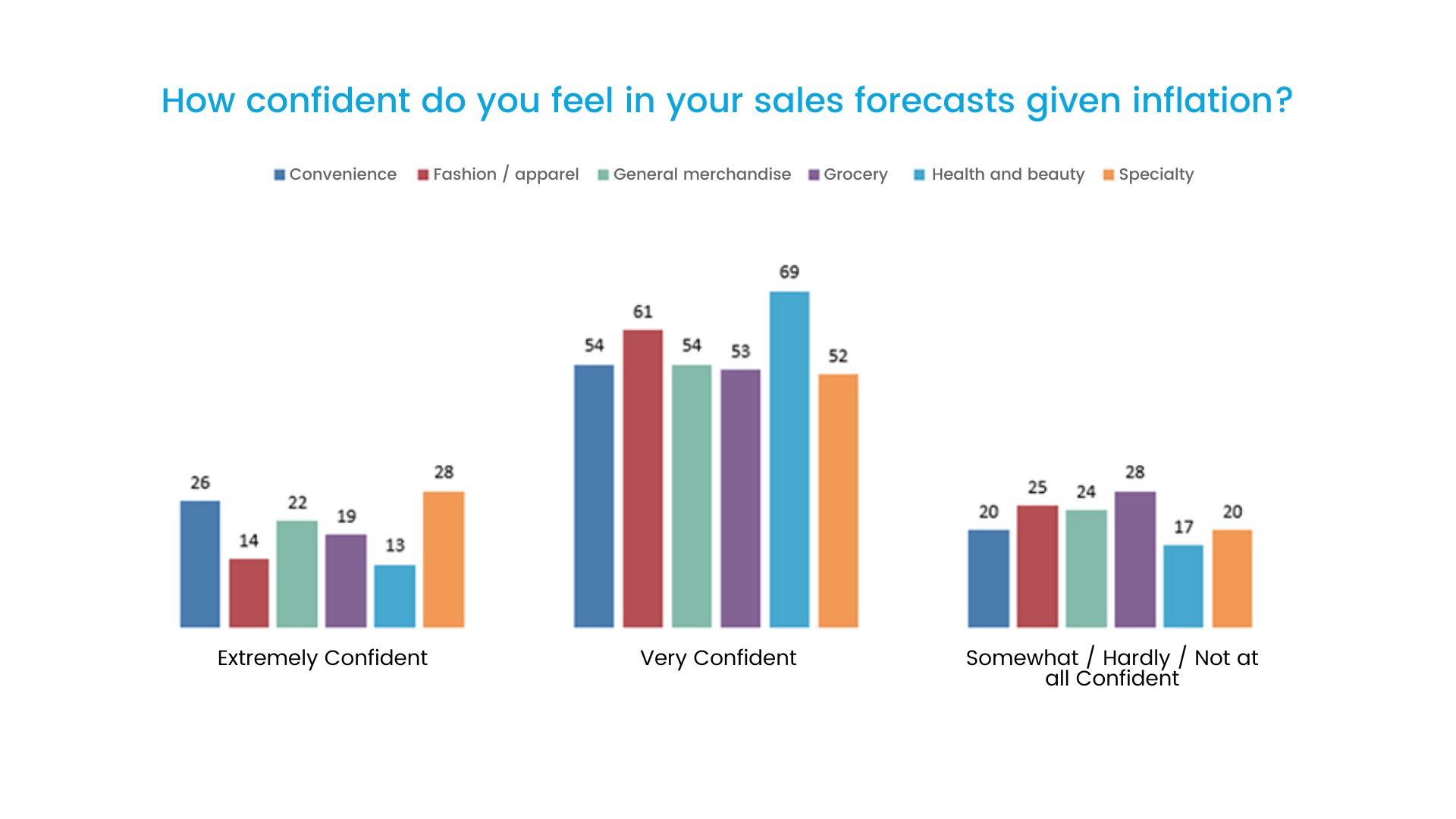

Convenience (26%) and specialty (28%) retailers reported extreme confidence in their sales forecasts. Meanwhile, 28% of grocers feel less than confident in their sales forecasts.

Why? It appears to have to do with their pricing strategies. Grocery retailers are also less confident in their pricing strategies than other verticals: only 64% of grocers say they feel extremely or very confident, substantially less than the next lowest vertical, convenience (74%).

Pricing teams aren’t as sure

Since we’re talking about pricing, it’s important we take a look at the confidence of the pricing teams themselves.

Overall, less than half of those in pricing and merchandising roles feel confident in their strategy through the rest of 2022. This is not a particularly great sign for retailers, as the Golden Quarter is such a critical time in the industry and seasonal promotions strategies are an essential piece of overall holiday planning.

But it’s easy to see why; never before has retail had to juggle so many challenges — especially of this magnitude — at the same time. Pricing is as vulnerable to these conditions as anything else. And unlike other struggles that may happen behind the scenes, price image is front and center for consumers.

2. Retailers going big on promotions

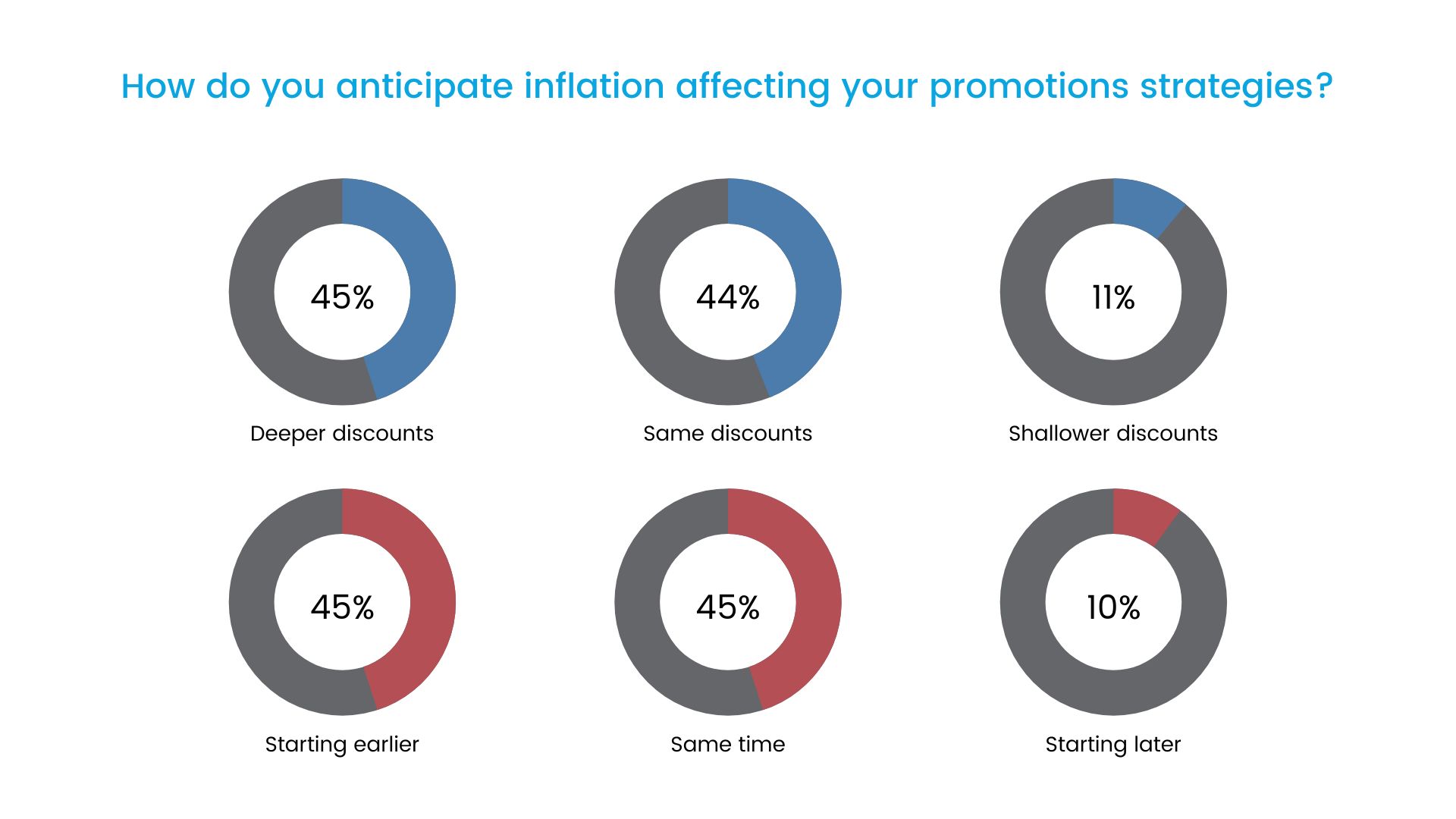

There’s a trend for 2022 holiday season promotions – the same or more. Only 10% of retailers are starting their promotions later, and only 11% are planning on smaller discounts. The rest are pretty evenly split between the same or greater discounts and the same or earlier timing.

The uncertainty around inflation and changing consumer behaviors is a driving factor behind why nearly half of retailers are planning the same discounts and same timing. When looking deeper, we found that the less confident a retailer was in the effectiveness of their promotions, the more likely they were to just rely on last year’s tactics.

On the other side, nearly half of respondents say their promotion strategies are getting more aggressive. Possibly as an attempt to capture wallet share at a time when discretionary spending is short, or perhaps to use the holidays as a time to leverage demand to deal with the inventory aftermath of a “lumpy” supply chain.

Looking at different verticals, there are slight differences in how retailers are trending toward their promotion strategies. For specialty retailers, 59% said they would offer deeper discounts versus only 41% of grocers and 43% of convenience retailers. However, 56% of convenience retailers said they would offer promotions earlier, with 43% of general merchandise retailers and 46% of grocers following suit.

3. Price perception is the top priority

Across the board, price perception is the #1 priority for retailers right now, no matter the region, vertical, or department. As retailers have been battling inflation and raising prices for almost two years now, it’s not much of a surprise that they would be concerned about the impacts on their price image.

For respondents in pricing and merchandising roles, 35% say fair price/price perception is their top strategic priority. Both North American (35%) and European (34%) retailers agree price image is at the top of the list as well. And every vertical cites price perception as its top priority, with one exception: convenience retailers say their top strategic priority is margin maintenance.

But let’s not give convenience a bad rap. When asked what strategic priorities have been harder to achieve this year, c-store retailers overwhelmingly (80%) answered — you guessed it — margin maintenance. So it makes sense the vertical’s biggest challenge this year would become its biggest priority moving forward.

In a highly competitive market where consumers have more options and pricing data than ever, price perception can be a key differentiator. Especially in a time of inflation and economic recession, retailers need a comprehensive approach to help balance price increases and decreases and protect price perception.

4. Retailers anticipate one to two more years of inflation

As much as we all want it to, the consumer price index won’t reset to standard rates when the New Year rings in. And while figures are trending in the right direction stateside, inflation appears to be here to stay.

At least for a little while.

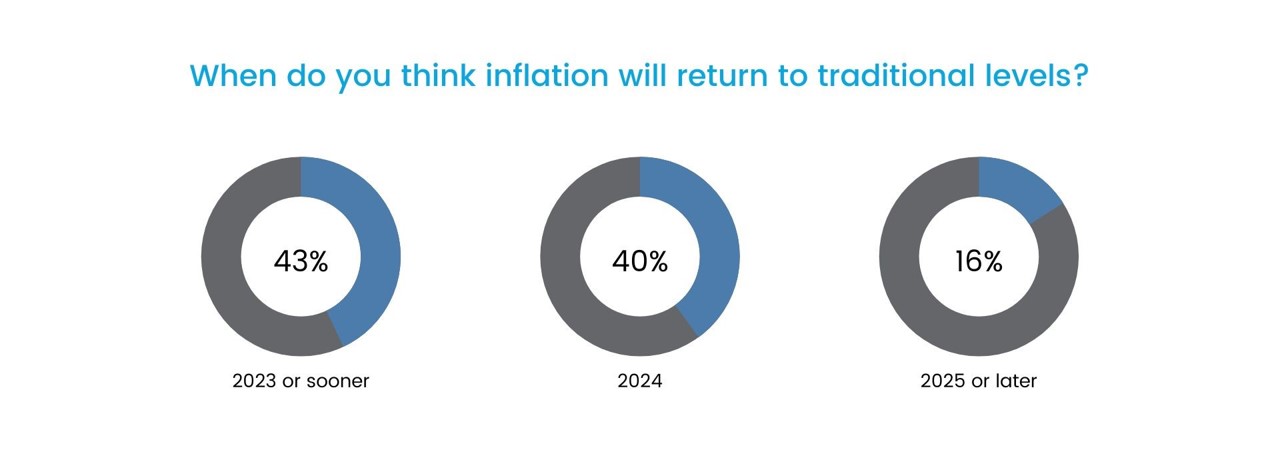

Our survey found that 43% of retailers believe inflation will return to traditional levels in 2023 or sooner, 40% believe it will take until 2024 to fall back to earth, and 16% think it won’t be until 2025 or later.

However, the beliefs diverge by region. North American retailers are more optimistic: 59% believe inflation will come to an end in either 2022 or 2023, with only 31% believing it will happen in 2024. But for European retailers, only 33% believe inflation will ease by 2023, 47% anticipate 2024, and 20% are not optimistic inflation will return to traditional levels until 2025 or later.

Regardless of timing, 37% of pricing teams feel unprepared to navigate disinflation when it does occur. Even if disinflation brings relief to the cost-of-living crisis and stretched budgets everywhere, it will mean more cost changes, consumer behavior shifts, and process adjustments for pricing teams to deal with. And just as many in the business have never handled such a level of inflation before, so, too, will they be inexperienced in handling the corresponding disinflation.

Approach pricing with confidence

The post-pandemic world has been rocky for the retail market, and it does not appear the constant change will relent by the end of 2022. This holiday season comes with a lot of optimism but still a lot of uncertainty.

To navigate the season, the end of the year, and the foreseeable future with any level of confidence, retailers need the right data analytics and strong forecasting tools to anticipate how consumers will shop and respond to different pricing scenarios. It takes agile pricing processes and an intelligent pricing solution to keep up with the fluctuating market and competitors’ pricing moves.

To approach pricing with clarity and confidence across all of your teams, whether in times of inflation, disinflation, or whatever retail brings us next, reach out to talk to one of our pricing experts.

And for more insights into the state of pricing in the retail industry, keep an eye out for our full pricing survey report coming early next year.

Research Methodology

The results in this report are from an online survey conducted by Researchscape International and commissioned by Revionics, an Aptos company. The survey was fielded from September 10 to November 5, 2022. There were 311 respondents to the survey. Respondents were from 11 different countries.

The responses were not weighted.

Duncan Llovio is a B2B content marketer with a passion for product and distribution. If he isn't writing and researching, he's either watching basketball or trying out a new recipe.